In this article we will learn about Stock Market Volatility and the do’s and don’ts of volatility. How can we successfully have control over our emotions while investing in the stock market during volatility?

The Nature of Stock Market Volatility

Financial markets are characterized by intrinsic market volatility. It relates to the daily swings in stock values, which show the market’s dynamism. Although volatility can offer investors opportunities, it frequently causes fear and panic during downward swings. Emotions play a big part in how people react to market volatility; therefore, controlling these emotions is essential for profitable trading.

The Emotional Rollercoaster: Reacting to Market Volatility

Insightful investor Warren Buffet once said, “If you cannot control your emotions, you cannot control your money.” Investors frequently experience intense emotional reactions in response to market volatility. When stock prices fall, people frequently experience fear and worry. As a result, some people may act impulsively and sell their investments at a loss. But giving in to these feelings can prevent long-term wealth accumulation.

Utilizing Stock Market Volatility: Possibilities in the Face of Chaos

Although market volatility can be disconcerting, it can also be a good thing for savvy investors. It is advantageous to see volatility as an opportunity to improve your investment portfolio rather than giving in to anxiety. Stock prices frequently undervalue themselves during market downturns, offering appealing entry possibilities for investors. People can take advantage of the possibility of higher profits during market downturns by keeping a long-term perspective and investing more money.

Also Read: Mastering Financial Education: The 5 Best Secrets Weapon for Kids’ Future Prosperity! 💪🌟

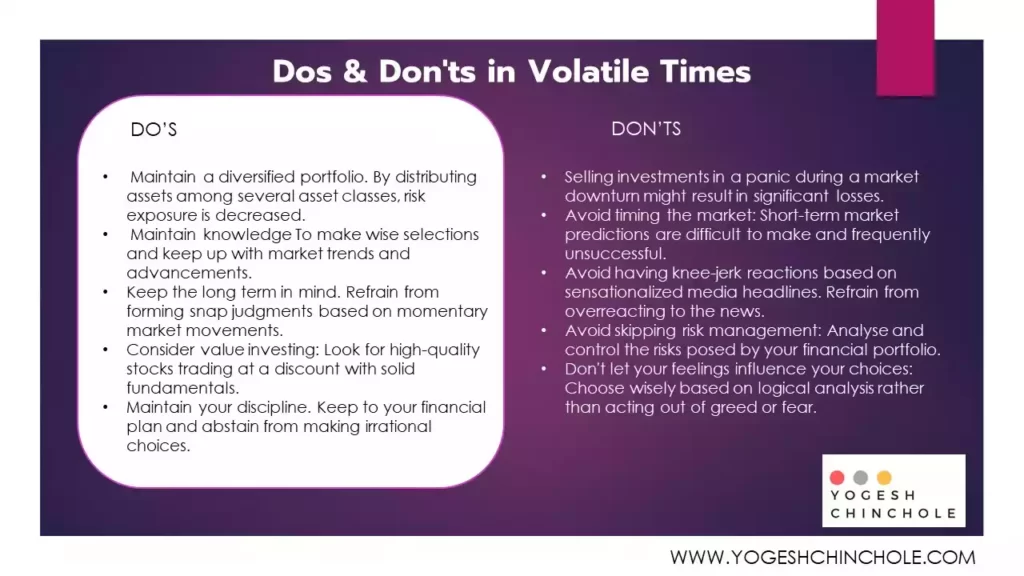

The Art of Investing: Dos and Don’ts in Stock Market Volatile Times

Investing involves more than technical or scientific knowledge; it also calls for creativity. Adhering to specific guidelines is the secret to profitable investment during market turbulence. Following are some suggestions for how to navigate choppy market conditions:

Do’s:

- Maintain a diversified portfolio. By distributing assets among several asset classes, risk exposure is decreased.

- Maintain knowledge To make wise selections and keep up with market trends and advancements.

- Keep the long term in mind. Refrain from forming snap judgments based on momentary market movements.

- Consider value investing: Look for high-quality stocks trading at a discount with solid fundamentals.

- Maintain your discipline. Keep to your financial plan and abstain from making irrational choices.

Don’ts:

- Selling investments in a panic during a market downturn might result in significant losses.

- Avoid timing the market: Short-term market predictions are difficult to make and frequently unsuccessful.

- Avoid having knee-jerk reactions based on sensationalized media headlines. Refrain from overreacting to the news.

- Avoid skipping risk management: Analyse and control the risks posed by your financial portfolio.

- Don’t let your feelings influence your choices: Choose wisely based on logical analysis rather than acting out of greed or fear.

Seek Professional Advice: A Financial Advisor’s Function

It can be challenging to navigate market volatility, especially for novice investors. Getting the advice of a qualified financial advisor can offer insightful assistance and assist you in making decisions.

FAQs: Frequently Asked Questions

Subscribe for Various Newsletters from Yogesh Chinchole

- Click Here to Subscribe to Email Newsletter by Yogesh Chinchole

- Click Here to Subscribe to LinkedIn Newsletter by Yogesh Chinchole

- Click Here to Subscribe to Medium Newsletter by Yogesh Chinchole

- Without Financial Goals are you directionless: Get Empowered by Setting Your Financial Goals 🗺

- Top 6 Insurance Riders for Your Health Insurance: A Quick Must Have Guide

- Mutual Fund KYC Forms 2024 – Get Latest KYC Forms for Mutual Funds

- KYC Validation, KYC Status, KYC Modification Links

- SIP vs SWP: A Comprehensive guide to investing and Withdrawing from Mutual Funds 2023